The challenges of digitisation in the insurance sector, analysed by Sara El Bekri, manager of FRIDAY

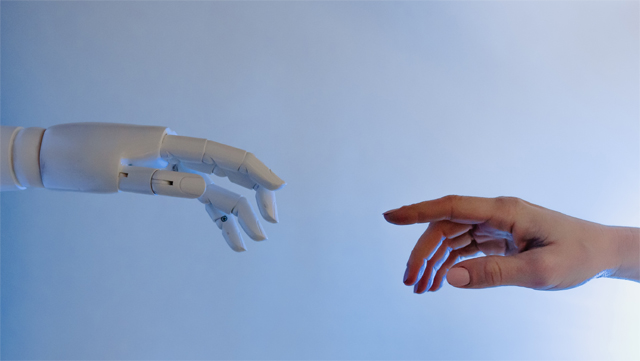

When it comes to the application of new technologies, services are rarely mentioned. This is probably because people in this field think that the human element is irreplaceable and that it is better to focus on it. Yet the two are perfectly inseparable. At least, that's what Sara El Bekri, the new director of FRIDAY, a digital insurance company, is demonstrating. Here she answers European Scientist's questions on the challenges of digitising insurance offerings and the use of new technologies in an increasingly competitive market.

The Europeanscientist : Following your appointment as head of FRIDAY, you clearly stated your ambition to "continue the spread of assurtech". Can you define this concept and tell us how you intend to develop it ?

Sara El Bekri : The term "assurtech" refers to companies that have positioned themselves to use technology to optimise and rethink the insurance sector. That's exactly where we come in. At FRIDAY, we are insurers in our own right: with a presence, a licence, a right to practice and a range of obligations. But with a strong digital background. We believe in two main areas: firstly, technological innovation; and secondly, the need to maintain the human element in our insurance work.

TES.: The insurance sector hesitated for a long time before taking the digital plunge. How do you explain this? Could it be that customers are wary of the avant-garde nature of digital solutions ?

SB. : We carried out a study with IFOP, which shows that 35% of French people and 54% of those under 25 believe that the arrival of new digital players will improve purchasing power. This study also proves that digital technology is perceived as a vector of rapid compensation and simplicity. And so far the market is proving us right. Our average customer rating is 4.7/5 on Trustpilot.

Today, we offer a product that we believe to be simple, with technology that is present where it makes sense and with a human presence that is maintained. I fundamentally believe that digitalisation in the world of insurance does not mean absolute digitisation of practices without a human presence. There are times when it makes sense: in underwriting, for example. If one of our policyholders has a child in the future, they can add him or her to their space completely independently. That's where digitisation comes into its own. On the other hand, if they need advice or their house has been damaged, for example, the telephone may still be the preferred method.

TES.: What are the major technological innovations that have made this digitalisation possible ? Can you name a few ?

SB. : The first innovation is not technical. The key lies in how we use it. It means asking ourselves: what is my customer's need? What is the best experience I can provide? For me, technology is a tool for getting as close as possible to the customer's expectations.

From there, there are many ways of doing this. We have AI, for example. One of the things we're thinking about is listening in on our advisers on the phone to capture a certain emotion and possibly a tone of voice that might have communicated an emotion at the time. We also have connected objects. Finally, we have data technologies. For example, if we find that customers go too far from one page to the next and that many of them go back four pages, we may have missed something in our customer journey and our promise of simplicity could be further optimised.

TES. : In the near future, do you intend to take advantage of ChatGPT-type LLMs to provide your customers with more service and greater responsiveness ?

SB. : We are obviously thinking about this. But for the moment, we're perhaps thinking about it more in the context of internal use. For example, we could carry out an analysis of market pre-data to help us be more efficient, or we could ask ourselves what the case law is around a case that we have, and so on. We're still in the reflection phase.

TES. Are you interested in the virtual reality technologies that are coming onto the market ? Is it conceivable that, in the future, thanks to these solutions, the insurer will no longer even have to travel to carry out a report?

SB. : Are we thinking about it? Yes, but do we use it? Not really. In the case you have just mentioned, we are offering video expertise. We suggest that policyholders, with their agreement of course, activate their phone and start reporting the damage they have suffered. We also do this in certain cases where we notice that there is a real appetite among customers and a real desire to have this exchange report.

Experience has shown that all the channels created in the past have never supplanted another. They have been added in response to a particular practice.

TES. How do you go about combining quality of service and digitalisation, when the latter is often perceived as the vector of a certain dehumanisation ?

SB. : We are a digital and human insurance company. Digitalisation is good for us and meets a need for greater efficiency in responding to our customers. In our practices, it is not systematic and the human element remains central. For example, on our Google reviews, all responses to comments are written in-house. There are three of us in the team who take it in turns to do this. We've realised that this is a market practice, so some of our customers will go and look at this rating and the comments that come out of it before they go on to take out a contract.

In practical terms, this human assistance translates into a response to urgent needs. Let's say you're locked out and the keys are inside the house. We offer an assistance service that will get someone to open the door for you as quickly as possible. This is included in our service.

TES. In addition to home insurance, you are launching a school insurance offer. What are your technical and commercial strengths in this segment ?

SB. : This is a segment that has become extremely competitive. So price is the key differentiator. We want this differentiation to be based on the quality/price ratio. This is the approach we have decided to take in recent years.

School insurance is compulsory cover for children. If a child causes damage at school for which he or she is responsible, such as breaking a friend's glasses, and the parent asks for compensation, we can make use of this insurance.

There are two ways of doing this: there are players who are positioned as fully-fledged school insurers. We have chosen to offer it as additional cover to our home insurance.

Home insurance is an everyday product, and even if the name given to it is 'comprehensive home insurance', we really see it as 'comprehensive everyday insurance'. Covering your bike, for example, when something happens to it outside your home is just as important, and that's ultimately what we've come to position ourselves around.

Source : Europeanscientist