Cameroon: The DGI suspends penalties and fines in case of late or failure to declare or pay taxes via tele-procedures.

Since January 2021, all Cameroonian taxpayers are now required to use electronic means of payment, among other means, to pay their taxes. For this year indeed, the reform of dematerialization of reporting and payment obligations formerly reserved for large companies (DGE) has been generalized to small taxpayers under the Divisional Tax Centers (CDI).

The implementation of tele-procedures (electronic filing and electronic payments) is therefore effective in the CDIs of the cities of Yaounde, Douala, Bamenda and Limbe since January 15, 2021. In order to accompany taxpayers during the initiation phase of tax tele-procedures, the Ministry of Finance and the Directorate General of Taxes (DGI) have extended the deadlines for tax declarations and payments for the first quarter of 2021 legally set at the 15th of each month for these taxpayers, respectively at the end of each month as follows : January 31, 2021; February 28, 2021 and March 31, 2021.

"This exceptional measure aims to accompany the interested parties during the initiation phase of the tax tele-procedures. The reform of tele-procedures thus initiated will be extended to the CDIs of the regional capitals as of April 1, 2021 and to all other CDIs as of July 1, 2021. The Minister of Finance is counting on the fiscal citizenship of all," said Finance Minister Louis-Paul Motaze in a press release issued on January 11, 2021.

For large companies that also had several tax payment options, the Director General of Taxes, Modeste Mopa Fatoing, stated that, in application of the tax legislation in force, taxpayers covered by the DGE will now pay their taxes exclusively through the telepayment procedure. He also invited the taxpayers concerned to contact their credit institutions for the formality of validation of the permanent authorizations of levy (APP).

On line Tax Payment (OTP)

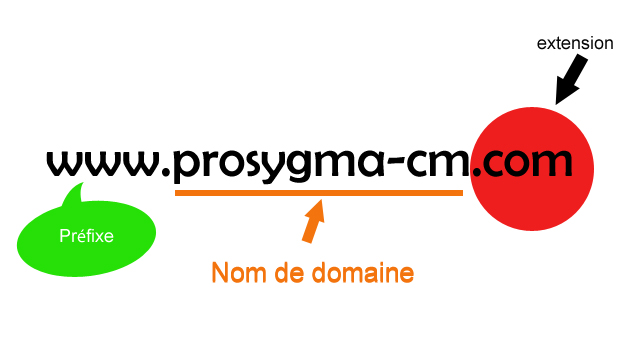

As a reminder, the telepayment platform, On line Tax Payment (OTP), is accessible at www.impots.cm and the DG des Impôts has instructed the services of the Direction des Grandes Entreprises to provide all necessary assistance to interested taxpayers for a better implementation of this payment procedure.

Clearly, in Cameroon, the only means of fulfilling tax obligations allowed in these centers are now the electronic declaration and payment by bank transfer, cash payment at bank counters or by cell phone (Mobile Tax). Therefore, no cash in the CDIs.

In order not to penalize Cameroonian taxpayers and to enable them to adapt to the new situation, the Director General of Taxes, Mopa Mopa Fatoing, in a circular note signed on February 26, 2021, asked his staff, mainly Directors and assimilated as well as the Heads of Regional Tax Centers, not to apply sanctions and fines to taxpayers who are late in paying their taxes.

Source: DigitalBusinessAfrica