Timber traceability: Tropical timber trade shaken in 2020 by Covid-19

The consequences of the Covid-19 pandemic were palpable on the production, consumption and trade of tropical timber in 2020, even if they were differentiated according to the major markets, shows the Biennial Review and Assessment of the World Timber Situation 2019-2020 published by the International Tropical Timber Organization (ITTO). Overall, there has been a sharp contraction but also an accentuation of previous trends.

Indeed, the production of tropical logs of ITTO members has fallen by 3.1% in 2020 to 285 million m3. This decline was due to the restrictive measures taken to combat Covid-19, which hampered harvesting operations but also limited freight capacity.

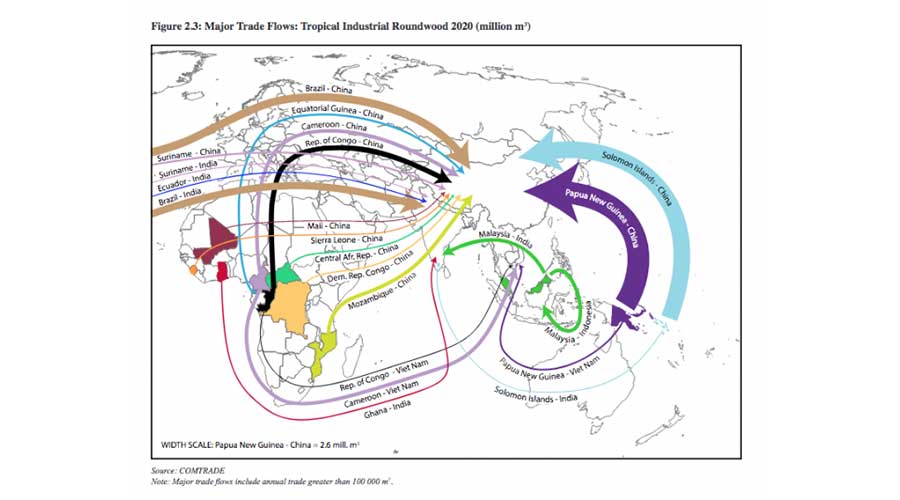

The contraction in trade was even greater, with the lowest volume reached in 2020 since 1987! The decline has been trending since 2014 and has continued. After a 16% contraction in 2019, imports fell 16% in 2020 to 12.2 million m3. China and India remain the main importing countries, capturing over 81% of tropical roundwood imports in 2020. In China, according to ITTO, after the contraction of more than 11% in 2020 (8.6 million m3), the rebound in construction activity in the second half of 2020 has led to a recovery in imports.

Papua New Guinea is the world's largest exporter of tropical logs, although its volume declined by 23% in 2020 to 2.9 million m3 . In the next ten years, the country is expected to see a further decline in exports, as the government, after taking restrictive measures in 2020, wants to take a step further by banning log exports by 2025.

"The reduced supply of logs from the Asia-Pacific region continues to put pressure on other sources of tropical log supply, particularly Africa, but also more recently Latin America and the Caribbean, where exports have soared to 2.2 million m3 in 2020, a level that has almost doubled compared to 2016," observes ITTO. A surge in Latin America mainly due to Brazil. From a negligible exporter before 2018, Brazil exported 1.4 million m'3 of logs in 2020, mainly to China and mainly eucalyptus species.

Continued trend decline in log exports to Africa

Tropical log exports from Africa continue to decline since peaking in 2016. From 4.5 million m3 in 2019, they have dropped to 2.3 million m3 in 2030. The cause? Both coronavirus control measures that have hampered production but also demand conditions in the main export markets. Cameroon, the Republic of Congo, Mozambique and Ghana were ITTO's top exporters in 2019, with China, Viet Nam and India the main export destinations.

European Union countries are declining in importance as African countries struggle to comply with the requirements of the EU Timber Regulation (EU-TBR) and its associated costs. In contrast, West and Central African countries are focusing on Middle Eastern countries and Asia, which are more flexible in their regulations than European countries.

Same trend for sawn timber and plywood

The Covid-19 pandemic also disrupted both supply and demand for tropical lumber and plywood in 2020. Sawnwood exports fell by 10% to 9.2 million m3 and plywood exports by 14% to 5.8 million m3.

Source: commodafrica.com